DFS - Concentrate Marketing

Bosnian Definitive Feasibility Study

10 September 2021

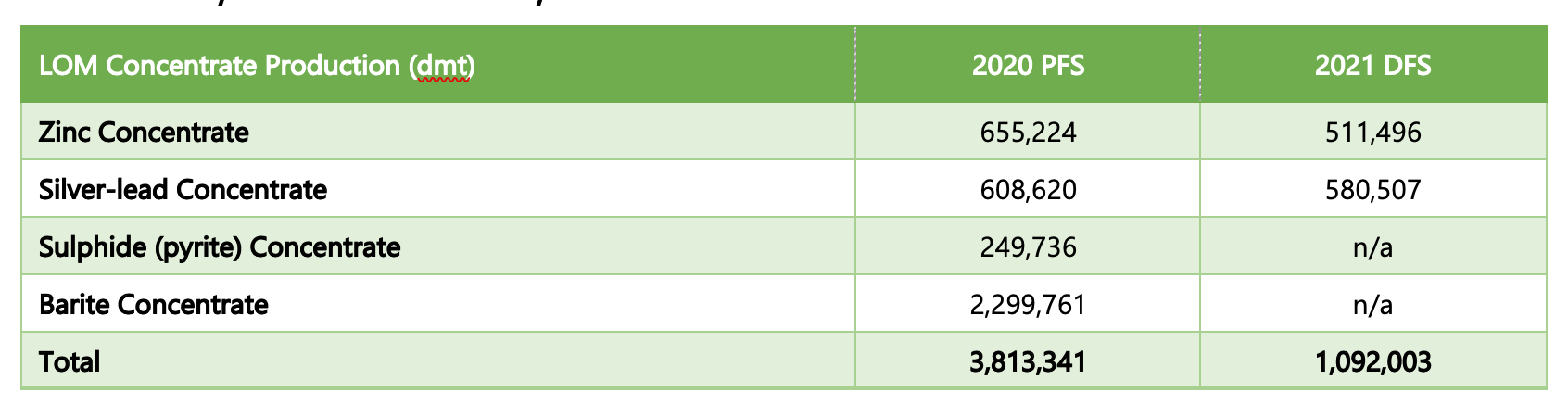

Changes from the 2020 PFS

Market research conducted by an independent barite marketing expert concluded that, while the barite concentrate had a suitable end-market, the current high bulk shipping rates negatively affected the ability to sell at profitable levels. Barite is primarily used as a drilling mud in oil and gas exploration activity which has been relatively subdued since the COVID-19 pandemic.

Insufficient interest in the sulphide (pyrite) concentrate, prompted a redesign of the process design for a commensurate decrease in capital expenditure.

The current design allows for a barite and sulphide (pyrite) circuit to be added in future.

Table 23: Comparison of concentrate production between 2020 PFS and 2021 DFS over LOM

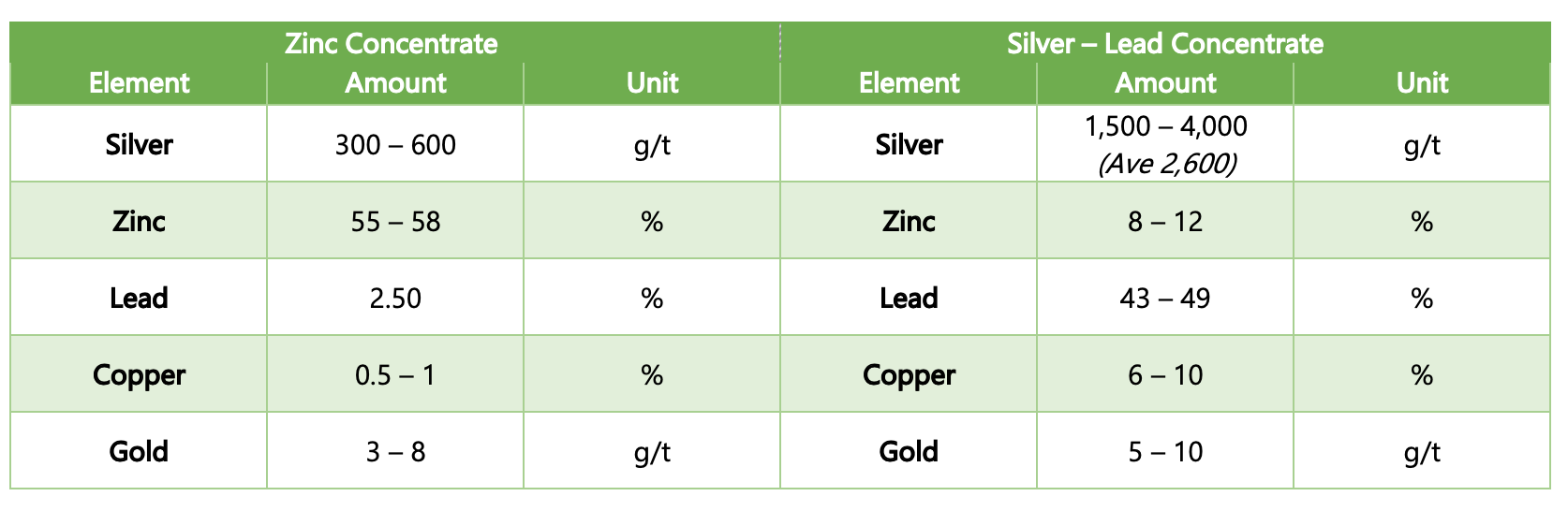

Concentrate Marketing Specifications

Adriatic Metals engaged the services of Bluequest Resources AG (“BQR”) to assist with the marketing of the silver-lead concentrate and zinc concentrate. Requests for proposals for both concentrates were sent to nine potential off-takers, all of which submitted bids.

Table 24: Contained metals in concentrate - average first 24 months

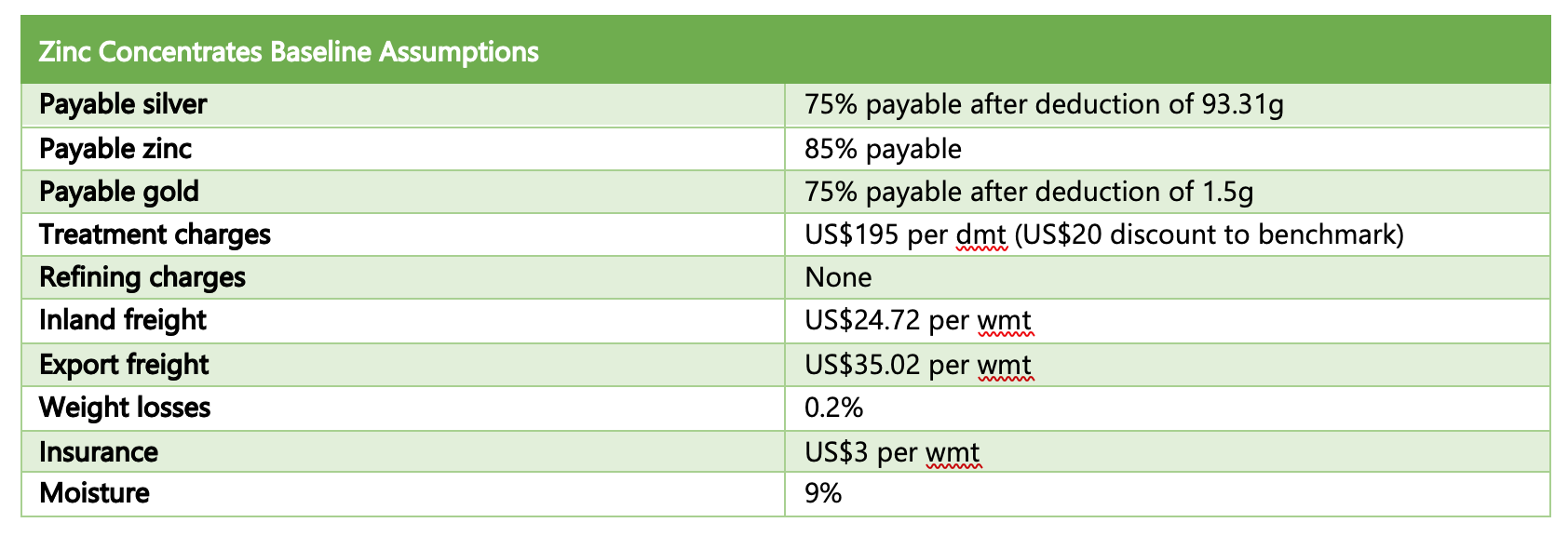

Zinc Concentrates

The zinc concentrate has a very low iron content, which is particularly advantageous for Roast-Leach-Electrowin smelters and interest from the potential off-takers has reflected this. Long-term benchmark treatment charge have recently settled at US$159 per dmt for 2021, and spot prices at US$75-85 per dmt. With this continued tightness in mind, BQR has assumed long-term benchmark terms for the LOM at US$195 per dmt (including a US$20 discount to benchmark).

The zinc concentrate contains some deleterious elements for which penalties will be payable in the range of US$10 – US$15 per dmt.

Table 25: Zinc concentrate baseline assumption

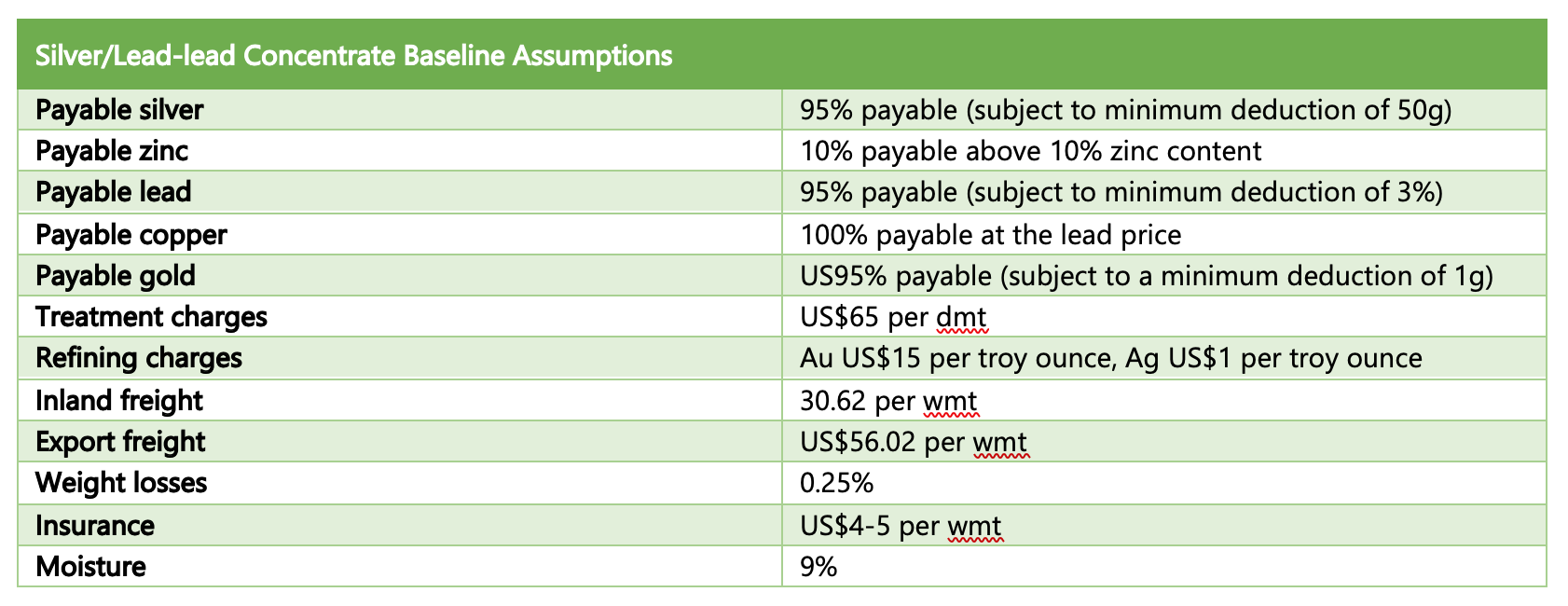

Silver/Lead Concentrates

High-silver content concentrates, similar to the Vares Silver Project's silver-lead concentrate, are especially attractive for Chinese lead smelters as it allows them to toll treat the payable elements under a more favourable tax import/export scheme. Traditionally, most of these high-silver Chinese smelters operate on the spot market and not under long term offtake agreements. Furthermore, Chinese smelters provide a higher payability for the minor metals in the concentrates (including antimony) typically paying for contained copper at a percentage of the copper price (as opposed to ex-China smelters that typically pay for contained copper at lead prices). Accordingly, the Vares Silver Project’s silver-lead concentrate has been priced at the average of the maximum/minimum spot settlements from 25th June 2021 at US$65 per dmt. Gold refining charges are holding at US$15 per troy ounce and whilst recent silver refining charges have settled as low as US$0.5 per troy ounce, US$1 per troy ounce has been assumed.

The silver/lead concentrate contains some deleterious elements for which penalties will be payable in the range of US$15 – US$20 per dmt.

Table 26: Silver-lead concentrate baseline assumption

Zinc Market

The zinc market has been buoyed by strong global demand and renewed interest from investors, seeking to gain exposure to the long-term zinc price outlook. Prices have comfortably held above the long-term five-year average (2015-2020) of US$2,544, and are consolidating, despite the recent surge in (recovering) Peruvian mine output and the release of strategic stockpiles of zinc (by the Chinese government) to dampen prices. Government-led infrastructure projects and strong automobile sales are expected to keep prices steady, as the world returns to work in the second half of 2021, releasing pent up demand fuelled by record personal savings accumulated during the COVID-19 pandemic. Refined zinc demand is expected by analysts to exceed mine output in the next few years. Significant price increases are needed to encourage further investment in new mines or expansion of existing mines.

Concentrate terms have remained low during 2021, as a result of significantly lower output from South American mines (in 2020), forcing smelters to cover tonnage shortfalls. This has resulted in tightening terms significantly below the 5-year and 10-year adjusted average benchmark treatment charges of US$204 per dmt and US$211 per dmt, respectively. Higher average prices have allowed Chinese smelters in particular, to benefit from the large free metal gains in recovery as they seek to top-up domestic supplied feed by importing additional tonnes from western mines. This can be expected to continue if prices consolidate their recent gains, i.e. suppressing treatment charges, creating a healthy outlook for mines for the foreseeable future.

Lead Market

Increasing pressures by governments to force greater recycling of lead products has seen lead prices challenged by a commensurate increased secondary supply. This has dampened prices relative to the surges seen in copper, nickel and zinc, where increased demand has driven prices markedly higher. Despite these headwinds, lead has continued to consolidate its recent gains and traded on a spot basis significantly above the 10-year average of US$2,079 per tonne.

Terms for spot high silver-lead concentrates have remained below the 5 and 10-year average silver-lead Benchmark terms of US$127 per dmt and US$172 per dmt, respectively. With limited supply increases in primary lead supply foreseen, smelters are expected to be continually challenged with securing long-term supplies at reasonable treatment charges.

Silver Market

Following the surge in prices in the second half of 2020, silver has spent most of 2021 consolidating its gains. Silver benefits from both industrial demand and its precious metal investment status. There has been increased physical demand from its use in the renewable energy sector, particularly photovoltaic cells and EV charging infrastructure. However, partial substitution by copper and aluminum in the next five years in this sector is likely to marginally weaken the longer-term demand outlook as the overall volume of this sector increases.

Despite this, prices have remained above the 10-year (2010-2020) average of US$21.05 per troy ounce and recent inflationary pressures bode well for its precious metal status as investors seek to migrate from bonds into fixed assets.